About What Percent of Families Has Little or No Wealth

CBO Nautical chart, U.S. Holdings of Family Wealth 1989 to 2013. The top 10% of families held 76% of the wealth in 2013, while the bottom fifty% of families held 1%. Inequality increased from 1989 to 2013.[1]

Wealth inequality in the Us, also known equally the wealth gap,[2] is the unequal distribution of assets amid residents of the United States. Wealth commonly includes the values of whatsoever homes, automobiles, personal valuables, businesses, savings, and investments, besides every bit whatever associated debts.[3] As of Q3 2019, the summit 10% of households in the United States held 70% of the state'southward wealth, while the lesser 50% held 2%.[four] Wealth commonly includes the values of any homes, automobiles, personal valuables, businesses, savings, and investments, as well as whatever associated debts.[v] From an international perspective, the difference in United states of america median and mean wealth per developed is over 600%.[half-dozen] A 2011 study found that US citizens across the political spectrum dramatically underestimate the electric current level of wealth inequality in the US, and would adopt a far more egalitarian distribution of wealth.[7]

Federal Reserve data indicates that from 1989 to 2019, wealth became increasingly concentrated in the meridian ane% and tiptop 10% due in big part to corporate stock buying concentration in those segments of the population; the lesser 50% ain lilliputian if whatever corporate stock.[viii] The gap between the wealth of the acme 10% and that of the heart form is over 1,000%; that increases some other 1,000% for the top i%.

Although different from income inequality, the two are related. More recently, in 2017, an Oxfam study found that only eight people, six of them Americans, ain as much combined wealth as half the homo race.[9] [10] [11]

Wealth is usually not used for daily expenditures or factored into household budgets, merely combined with income, it represents a family'south total opportunity to secure stature and a meaningful standard of living, or to pass their class status downwardly to their children.[12] Moreover, wealth provides for both brusk- and long-term financial security, bestows social prestige, contributes to political power, and tin can be leveraged to obtain more than wealth.[thirteen] Hence, wealth provides mobility and agency—the ability to deed. The accumulation of wealth enables a variety of freedoms, and removes limits on life that one might otherwise face up.

A September 2014 study by Harvard Business School declared that the growing disparity between the very wealthy and the lower and center classes is no longer sustainable.[fourteen]

Statistics [edit]

<div fashion="border:solid transparent;position:absolute;width:100px;line-height:0;

Distribution of internet worth in the United States (2007).[fifteen] The net wealth of many people in the everyman 20% is negative considering of debt.[15] By 2014 the wealth gap deepened.[16]

Acme 1% (35%)

Next four% (27%)

Adjacent v% (11%)

Next 10% (12%)

Upper Middle 20% (11%)

Middle xx% (4%)

Bottom xl% (<one%)

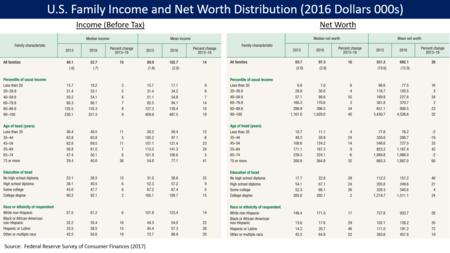

Average and median household income past historic period group

In 2007, the top 20% wealthiest Americans possessed 80% of all financial assets.[17] In 2007 the richest one% of the American population endemic 35% of the country'due south full wealth, and the next 19% owned 51%. The top 20% of Americans endemic 86% of the country'southward wealth and the bottom 80% of the population owned 14%. In 2011, fiscal inequality was greater than inequality in total wealth, with the tiptop 1% of the population owning 43%, the side by side 19% of Americans owning fifty%, and the bottom fourscore% owning 7%.[eighteen] However, after the Bully Recession, which began in 2007, the share of full wealth endemic past the acme 1% of the population grew from 35% to 37%, and that owned past the height twenty% of Americans grew from 86% to 88%. The Corking Recession also caused a drop of 36% in median household wealth, but a drop of merely xi% for the top 1%, further widening the gap between the top one% and the bottom 99%.[15] [18] [19]

Co-ordinate to PolitiFact and other sources, in 2011, the 400 wealthiest Americans had more than wealth than half of all Americans combined.[20] [21] Inherited wealth may assist explain why many Americans who accept become rich may take had a substantial head beginning.[22] [23] In September 2012, according to the Plant for Policy Studies, over sixty percent of the Forbes richest 400 Americans grew upward in substantial privilege.[24]

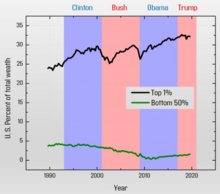

Distribution of household wealth for the Peak 1% and Bottom 50% in the U.S. since 1989, from the Federal Reserve (Wealth by wealth percentile group (Shares (%))). Colored regions indicate the presidencies of Beak Clinton, George W. Bush, Barack Obama, and Donald Trump, respectively.[25]

In 2013, wealth inequality in the U.S. was greater than in most developed countries, other than Switzerland and Denmark.[26] In the United States, the apply of offshore holdings is exceptionally small compared to Europe, where much of the wealth of the peak percentiles is kept in offshore holdings.[27] According to a 2014 Credit Suisse study, the ratio of wealth to household income is the highest it has been since the Great Depression.[28]

Co-ordinate to a paper published by the Federal Reserve in 1997, "For most households, pensions and Social Security are the nearly important sources of income during retirement, and the promised benefit stream constitutes a sizable fraction of household wealth" and "including pensions and Social Security in internet worth makes the distribution more than even".[29]

In Inequality for All—a 2013 documentary, narrated past Robert Reich, in which he argues that income inequality is the defining issue of the United States—Reich states that 95% of economic gains following the economic recovery which began in 2009 went to the pinnacle 1% of Americans (by net worth) (HNWI).[30]

A September 2017 report past the Federal Reserve reported that the elevation i% endemic 38.5% of the country's wealth in 2016.[31]

According to a June 2017 report by the Boston Consulting Group, around 70% of the nation'south wealth will exist in the hands of millionaires and billionaires by 2021.[32]

A 2019 study past economists Emmanuel Saez and Gabriel Zucman establish that the average effective taxation rate paid past the richest 400 families (0.003%) in the US was 23 pct, more than a percentage point lower than the 24.ii per centum paid by the bottom one-half of American households.[33] [34] The Urban-Brookings Tax Policy Middle found that the lesser 20 percentage of earners pay an average 2.9 percent effective income tax rate federally, while the richest 1 pct paid an effective 29.6 percent tax rate and the top 0.01 percent paid an effective 30.half-dozen percent revenue enhancement charge per unit.[35] In 2019, the Constitute on Taxation and Economic Policy found that when state and federal taxes are taken into account, however, the poorest 20 percent pay an effective twenty.2 percent charge per unit while the elevation one percent pay an effective 33.7 percent rate.[36]

Using Federal Reserve data, the Washington Middle for Equitable Growth reported in August 2019 that: "Looking at the cumulative growth of wealth disaggregated by group, nosotros meet that the bottom 50 percentage of wealth owners experienced no net wealth growth since 1989. At the other end of the spectrum, the top one percent have seen their wealth grow past almost 300 percent since 1989. Although cumulative wealth growth was relatively similar among all wealth groups through the 1990s, the meridian 1 percent and bottom 50 percent diverged around 2000."[37]

According to an analysis of Survey of Consumer Finances data from 2019 by the People'south Policy Projection, 79% of the country'due south wealth is owned by millionaires and billionaires.[38] [39]

Also in 2019, PolitiFact reported that three people (less than the 400 reported in 2011) had more than wealth than the lesser one-half of all Americans.[40] [41] [42]

During the COVID-xix pandemic, the wealth held past billionaires in the U.Southward. increased by 70%.[43] According to the 2022 Earth Inequality Written report, "2020 marked the steepest increase in global billionaires' share of wealth on record."[44]

Early on 20th century [edit]

Simon Kuznets, using income tax records and his own enquiry-based estimates, showed a reduction of about 10% in the movement of national income toward the tiptop 10% of wealth-owners, a reduction from about 45–50% in 1913 to about 30–35% in 1948.[45] This period spans both The Dandy Depression and World War Ii, events with significant economic consequences. This is chosen the Swell Compression.

1989 to 2020 [edit]

Effect of stock market place gains [edit]

The Federal Reserve publishes information on the distribution of household assets, debt and equity (cyberspace worth) by quarter going back to 1989. The tables beneath summarize the cyberspace worth data, in real terms (adapted for inflation), for 1989 to 2020, and 2016 to 2020.[46] [4] Journalist Matthew Yglesias explained in June 2019 how the ownership of stock has driven wealth inequality, as the lesser 50% has minimal stock buying: "...[T]he bottom half of the income distribution had a huge share of its wealth tied upwards in real estate while owning essentially no shares of corporate stock. The top 1 percent, past contrast, wasn't just rich — it was specifically rich in terms of owning companies, both stock in publicly traded ones ("corporate equities") and shares of closely held ones ("individual businesses")...So the value of those specific avails — avails that people in the lesser half of the distribution never had a chance to own in the first place — soared."[8]

NPR also reported in 2017 that the bottom l% of U.S. households (by net worth) take picayune stock market exposure (neither directly nor indirectly through 401k plans), writing: "That means the stock market place rally can just directly benefit effectually half of all Americans — and essentially fewer than it would take a decade ago, when nigh two-thirds of families endemic stock."[47]

| Household Internet Worth | Top 1% | 90th to 99th | 50th to 90th | Lesser 50% | Total |

|---|---|---|---|---|---|

| Q3 1989 ($ trillions) | ten.03 | 15.86 | xv.eleven | i.58 | 42.58 |

| Q2 2020 ($ trillions) | 34.68 | 43.67 | 33.08 | 2.xi | 113.54 |

| Increase ($ trillions) | 24.65 | 27.81 | 17.97 | 0.53 | seventy.96 |

| % Increase | 246% | 175% | 119% | 34% | 167% |

| Share of Increase (Increase/Full Increase) | 34.7% | 39.2% | 25.3% | 0.seven% | 100% |

| (Intentionally left blank) | |||||

| Share of Cyberspace Worth Q3 1989 | 23.6% | 37.2% | 35.5% | 3.7% | 100% |

| Share of Net Worth Q2 2020 | xxx.5% | 38.5% | 29.one% | 1.9% | 100% |

| Alter in Share | +seven.0% | +ane.2% | -half dozen.4% | -ane.nine% | 0.0% |

The table beneath shows changes from Q4 2016 (the stop of the Obama Assistants) to Q2 2020.[46]

| Household Net Worth | Acme 1% | 90th to 99th | 50th to 90th | Bottom 50% | Total |

|---|---|---|---|---|---|

| Q4 2016 ($ trillions) | 30.26 | 37.10 | 28.67 | 1.23 | 97.26 |

| Q2 2020 ($ trillions) | 34.68 | 43.67 | 33.08 | 2.11 | 113.54 |

| Increment ($ trillions) | 4.42 | half-dozen.57 | 4.41 | 0.88 | 16.28 |

| % Increase | 14.6% | 17.vii% | 15.4% | 71.v% | 16.7% |

| Share of Increase (Increase/Total Increment) | 27.i% | forty.4% | 27.ane% | 5.4% | 100% |

| (Intentionally left bare) | |||||

| Share of Cyberspace Worth Q4 2016 | 31.1% | 38.1% | 29.five% | ane.three% | 100% |

| Share of Internet Worth Q2 2020 | xxx.v% | 38.5% | 29.i% | 1.9% | 100% |

| Modify in Share | -0.half dozen% | +0.3% | -0.3% | +0.6% | 0.0% |

Wealth and income [edit]

There is an of import distinction between income and wealth. Income refers to a flow of money over time, commonly in the form of a wage or salary; wealth is a collection of assets endemic, minus liabilities. In essence, income is what people receive through work, retirement, or social welfare whereas wealth is what people own.[48] While the two are related, income inequality alone is insufficient for understanding economic inequality for two reasons:

- It does not accurately reflect an individual's economic position

- Income does not portray the severity of financial inequality in the United states.

In 1998, Dennis Gilbert asserted that the standard of living of the working and middle classes is dependent primarily upon income and wages, while the rich tend to rely on wealth, distinguishing them from the vast majority of Americans.[49]

The U.s. Census Bureau formally defines income as money received on a regular basis (exclusive of sure coin receipts such equally capital gains) before payments on personal income taxes, social security, spousal relationship ante, medicare deductions, etc.[50] Past this official measure, the wealthiest families may have low income, but the value of their assets may be enough money to support their lifestyle. Dividends from trusts or gains in the stock market do not fall under the aforementioned definition of income, but are commonly the primary source of upper-case letter for the ultra-wealthy. Retired people also accept fiddling income, but may take a high net worth, because of coin saved over time.[51]

Additionally, income does not capture the extent of wealth inequality. Wealth is near usually obtained over time, through the steady investing of income, and the growth of avails. The income of one year does not typically encompass the accumulation over a lifetime. Income statistics cover also narrow a time bridge for it to exist an adequate indicator of financial inequality. For example, the Gini coefficient for wealth inequality increased from 0.fourscore in 1983 to 0.84 in 1989. In the same twelvemonth, 1989, the Gini coefficient for income was only 0.52.[51] The Gini coefficient is an economic tool on a scale from 0 to ane that measures the level of inequality. one signifies perfect inequality and 0 represents perfect equality. From this data, information technology is evident that in 1989 there was a discrepancy in the level of economical disparity; the extent of wealth inequality was significantly higher than income inequality. Recent research shows that many households, in particular, those headed by immature parents (younger than 35), minorities, and individuals with low educational attainment, display very footling accumulation. Many have no financial avails and their total net worth is also low.[52]

According to the Congressional Budget Part, between 1979 and 2007, incomes of the tiptop 1% of Americans grew by an average of 275%.[53] (Note: The IRS insists that comparisons of adjusted gross income pre-1987 and post-1987 are complicated past large changes in the definition of AGI, which led to households within the meridian income quintile reporting more of their income on their individual income tax form's AGI, rather than reporting their business income in separate corporate revenue enhancement returns, or not reporting certain non-taxable income in their AGI at all, such as municipal bail income. In add-on, IRS studies consistently evidence that a majority of households in the top income quintile accept moved to a lower quintile within one decade. There are even more changes to households in the top one%. Without including those data here, a reader is likely to assume households in the top ane% are almost the aforementioned from year to year.[ citation needed ]) In 2009, people in the tiptop 1% of taxpayers fabricated $343,927 or more.[54] [55] [56] According to U.s.a. economist Joseph Stiglitz the richest 1% of Americans gained 93% of the additional income created in 2010.[57] [58]

A study by Emmanuel Saez and Piketty showed that the top 10 percent of earners took more half of the land's total income in 2012, the highest level recorded since the government began collecting the relevant data a century ago.[59] People in the top i per centum were iii times more than likely to work more than 50 hours a week, were more likely to be self-employed, and earned a fifth of their income every bit upper-case letter income.[lx] The top ane percent was composed of many professions and had an annual turnover charge per unit of more than 25%.[61] The five most common professions were managers, physicians, administrators, lawyers, and teachers.[sixty]

U.S. stock market ownership distribution [edit]

| Stock owned by richest x%. [47] [62] | |

| 2016 | 84% |

| 2013 | 81% |

| 2001 | 71% |

In March 2017, NPR summarized the distribution of U.Due south. stock market ownership (direct and indirect through mutual funds) in the U.S., which is highly concentrated amidst the wealthiest families:[47]

- 52% of U.S. adults owned stock in 2016. Buying peaked at 65% in 2007 and fell significantly due to the Great Recession.

- Equally of 2013, the top 1% of households owned 38% of stock market wealth.

- As of 2013, the pinnacle x% ain 81% of stock wealth, the next ten% (80th to 90th percentile) own xi% and the bottom lxxx% own 8%.

The Federal Reserve reported the median value of stock ownership by income group for 2016:

- Bottom 20% own $v,800.

- 20th-40th percentile ain $ten,000.

- 40th to 60th percentile own $15,500.

- 60th to 80th percentile own $31,700.

- 80th to 89th percentile own $82,000.

- Top ten% own $365,000.[64]

NPR reported that when politicians reference the stock marketplace every bit a measure of economic success, that success is not relevant to nearly one-half of Americans. Farther, more than one-third of Americans who work full-time take no access to pensions or retirement accounts such as 401(m)s that derive their value from financial assets like stocks and bonds.[47] The NYT reported that the percent of workers covered by generous defined-benefit alimony plans has declined from 62% in 1983 to 17% past 2016.[64] While some economists consider an increase in the stock marketplace to have a "wealth effect" that increases economical growth, economists like Former Dallas Federal Reserve Banking company President Richard Fisher believe those effects are limited.[47]

Causes of wealth inequality [edit]

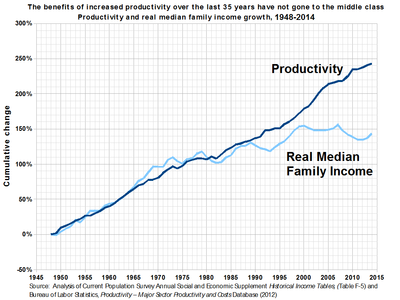

The income growth of the typical American family unit closely matched that of economical productivity until some time in the 1970s. While it began to stagnate, productivity has continued to climb.[65] According to the 2014 Global Wage Study by the International Labour Arrangement, the widening disparity between wages and productivity is evidence that there has been a significant shift of Gross domestic product share going from labor to capital, and this trend is playing a significant role in growing inequality.[66]

Selected economic variables related to wealth and income equality, comparing 1979, 2007, and 2015.

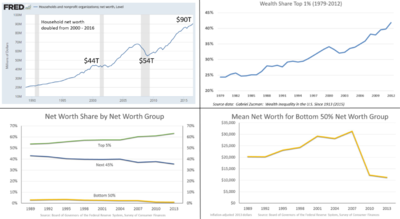

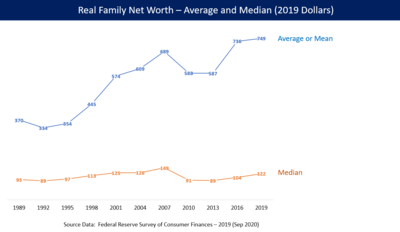

The image contains several charts related to U.South. wealth inequality. While U.South. net worth roughly doubled from 2000 to 2016, the gains went primarily to the wealthy.

U.S. median family net worth peaked in 2007, declined due to the Great Recession until 2013, and only partially recovered by 2016.[67]

Essentially, the wealthy possess greater financial opportunities that let their money to make more money. Earnings from the stock market or mutual funds are reinvested to produce a larger return. Over time, the sum that is invested becomes progressively more substantial. Those who are not wealthy, notwithstanding, exercise not have the resources to enhance their opportunities and improve their economic position. Rather, "after debt payments, poor families are constrained to spend the remaining income on items that volition not produce wealth and will depreciate over time."[68] Scholar David B. Grusky notes that "62 per centum of households headed by unmarried parents are without savings or other financial assets."[69] Net indebtedness by and large prevents the poor from having any opportunity to accumulate wealth and thereby better their conditions.

Economic inequality is too a event of difference in income. Factors that contribute to this gap in wages are things such every bit level of education, labor market demand and supply, gender differences, growth in engineering science, and personal abilities. The quality and level of education that a person has often corresponds to their skill level, which is justified past their income. Wages are as well adamant by the "market cost of a skill" at that current time. Although gender inequality is a separate social issue, it plays a role in economic inequality. According to the U.S. Census Report, in America the median full-time salary for women is 77 percent of that for men. As well contributing to the wealth inequality in the U.Southward., both unskilled and skilled workers are existence replaced past machinery. The Seven Pillars Constitute for Global Finance and Ideals argues that considering of this "technological advance", the income gap between workers and owners has widened.[70]

Income inequality contributes to wealth inequality. For example, economist Emmanuel Saez wrote in June 2016 that the elevation 1% of families captured 52% of the full real income (GDP) growth per family unit from 2009 to 2015. From 2009 to 2012, the peak i% captured 91% of the income gains.[71]

Notably, for both the wealthy and not-wealthy, the procedure of accumulation or debt is cyclical. The rich use their money to earn larger returns and the poor accept no savings with which to produce returns or eliminate debt. Unlike income, both facets are generational. Wealthy families pass down their assets allowing future generations to develop even more than wealth. The poor, on the other hand, are less able to leave inheritances to their children leaving the latter with footling or no wealth on which to build...This is some other reason why wealth inequality is so of import. Its aggregating has direct implications for economical inequality among the children of today'south families.[68]

Corresponding to financial resources, the wealthy strategically organize their money so that it will produce profit. Flush people are more than likely to allocate their coin to fiscal assets such as stocks, bonds, and other investments which agree the possibility of capital appreciation. Those who are not wealthy are more than likely to have their money in savings accounts and abode buying.[72] This difference comprises the largest reason for the continuation of wealth inequality in America: the rich are accumulating more than assets while the center and working classes are just getting by. Equally of 2007, the richest 1% held about 38% of all privately held wealth in the United States.[17] while the bottom 90% held 73.ii% of all debt.[68] According to The New York Times, the richest 1 percentage in the United States now own more wealth than the lesser ninety percent.[73]

Notwithstanding, other studies fence that higher average savings rate will contribute to the reduction of the share of wealth owned by the rich. The reason is that the rich in wealth are not necessarily the individuals with the highest income. Therefore, the relative wealth share of poorer quintiles of the population would increase if the savings charge per unit of income is very large, although the absolute difference from the wealthiest volition increase.[74] [75] [76]

The nature of tax policies in America has been suggested by economists and politicians such as Emmanuel Saez, Thomas Piketty, and Barack Obama to perpetuate economic inequality in America past steering large sums of wealth into the hands of the wealthiest Americans. The mechanism for this is that when the wealthy avoid paying taxes, wealth concentrates to their coffers and the poor go into debt.[77]

The economist Joseph Stiglitz argues that "Potent unions have helped to reduce inequality, whereas weaker unions have made information technology easier for CEOs, sometimes working with market forces that they have helped shape, to increment it." The long fall in unionization in the U.Due south. since WWII has seen a corresponding rise in the inequality of wealth and income.[78]

Some taxation policies subsidize wealthy people more than than poor people; critics frequently contend the home mortgage involvement deduction should exist abolished because it provides more tax relief for people in college tax brackets and with more expensive homes, and that poorer people are more oft renters and therefore less probable to be able to use this deduction at all. Regressive taxes include payroll taxes, sales taxes, and fuel taxes.

Racial disparities [edit]

The wealth gap between white and black families near tripled from $85,000 in 1984 to $236,500 in 2009.[79]

A Brandeis Academy Institute on Assets and Social Policy newspaper cites the number of years of homeownership, household income, unemployment, education, and inheritance as leading causes for the growth of the gap, last homeownership to be the most important.[79] Inheritance can directly link the disadvantaged economic position and prospects of today'south blacks to the disadvantaged positions of their parents' and grandparents' generations, according to a report done by Robert B. Avery and Michael S. Rendall that pointed out "1 in 3 white households will receive a substantial inheritance during their lifetime compared to just one in ten black households."[80] In the periodical Sociological Perspectives, Lisa Keister reports that family unit size and structure during childhood "are related to racial differences in adult wealth aggregating trajectories, assuasive whites to begin accumulating high-yield assets earlier in life."[81]

The article "America'south Financial Split up" added context to racial wealth inequality, stating:

... nearly 96.i percent of the i.ii 1000000 households in the acme ane percentage by income were white, a total of most i,150,000 households. In add-on, these families were establish to accept a median net asset worth of $eight.three million. In stark contrast, in the same piece, blackness households were shown as a mere 1.4 percent of the height one percentage past income, that'southward only 16,800 homes. In addition, their median net asset worth was just $1.ii million. Using this data equally an indicator merely several thousand of the over 14 million African American households have more than $1.2 million in net assets ...[82]

Relying on information from Credit Suisse and Brandeis Academy'due south Institute on Avails and Social Policy, the Harvard Business organization Review in the article "How America'southward Wealthiest Blackness Families Invest Coin" stated:[ commendation needed ]

If you're white and have a net worth of nearly $356,000, that'southward good plenty to put y'all in the 72nd percentile of white families. If you're black, it's skillful plenty to catapult you into the 95th percentile." This means 28 percent of the total 83 million white homes, or over 23 one thousand thousand white households, have more than $356,000 in internet assets. While only 700,000 of the xiv million blackness homes take more than $356,000 in total net worth.

According to Inequality.org, the median black family is only worth $1,700 when durables are deducted.[83] In contrast, the median white family holds $116,800 of wealth using the aforementioned bookkeeping methods.[83] Today, using Wolff's analysis, the median African American family unit holds a mere i.5 percentage of median white American family wealth.[83]

A recent piece on Eurweb/Electronic Urban Written report, "Black Wealth Hardly Exists, Even When Y'all Include NBA, NFL and Rap Stars", stated this about the difference between black middle-class families and white middle-class families:

Going even farther into the information, a recent study past the Institute for Policy Studies (IPS) and the Corporation For Economical Development (CFED) found that it would take 228 years for the average blackness family to amass the same level of wealth the boilerplate white family holds today in 2016. All while white families create even more than wealth over those aforementioned ii hundred years. In fact, this is a gap that will never close if America stays on its current economic path. Co-ordinate to the Found on Avails and Social Policy, for each dollar of increase in average income an African American household saw from 1984 to 2009 just $0.69 in additional wealth was generated, compared with the same dollar in increased income creating an boosted $5.19 in wealth for a similarly situated white household.[84]

Author Lilian Singh wrote on why the perceptions almost black life created by media are misleading in the American Prospect commodity "Black Wealth On TV: Realities Don't Match Perceptions":

Black programming features Tv set shows that collectively create faux perceptions of wealth for African-American families. The images displayed are in stark contrast to the economic weather condition the average black family unit is battling each day.[85]

According to an article past the Pew Research Middle, the median wealth of non-Hispanic black households fell well-nigh 38% from 2010 to 2013.[86] During that time, the median wealth of those households fell from $16,600 to $xiii,700. The median wealth of Hispanic families brutal fourteen.iii% as well, from $sixteen,000 to $14,000. Despite the median internet worth of all households in the The states decreasing with time, as of 2013, white households had a median net worth of $141,900 while black business firm households had a median net worth of just $11,000.[86] Hispanic households had a median cyberspace worth of only $13,700 over that time likewise.[86]

Effect on democracy [edit]

![]()

As of 2021, Jeff Bezos is the richest person in the globe.

A 2014 study by researchers at Princeton and Northwestern concludes that government policies reflect the desires of the wealthy, and that the vast majority of American citizens take "minuscule, virtually-zip, statistically non-significant impact upon public policy ... when a bulk of citizens disagrees with economic elites and/or with organized interests, they generally lose."[87] [88] When Fed chair Janet Yellen was questioned past Bernie Sanders most the written report at a congressional hearing in May 2014, she responded "There's no question that we've had a tendency toward growing inequality" and that this tendency "can shape [and] make up one's mind the ability of different groups to participate equally in a democracy and have grave furnishings on social stability over time."[89]

In Capital in the Twenty-Starting time Century, French economist Thomas Piketty argues that "extremely high levels" of wealth inequality are "incompatible with the meritocratic values and principles of social justice primal to mod autonomous societies" and that "the run a risk of a drift towards oligarchy is real and gives little reason for optimism about where the United States is headed."[ninety]

Effect on health and well-being [edit]

The 2019 World Happiness Report shows the US slipping to 19th identify due to increasing wealth inequality, along with rising healthcare costs, surging habit rates, and an unhealthy piece of work–life residual.[91]

Proposals to reduce wealth inequality [edit]

Trends in share of wealth held by diverse wealth groups 1989-2019[92]

Inheritance tax [edit]

In that location is an agile political argue over the manor tax in the United states of america, which reduces inequality past taxing the inheritance of large quantities of wealth. The Tax Cuts and Jobs Act of 2017 exempted estates under $11.eighteen meg per taxpayer, pregnant the tax currently just affects about ii,000 estates per twelvemonth.[93]

A 2021 investigation using leaked IRS documents found more half of the richest 100 Americans are using grantor retained annuity trusts to avert paying manor taxes when they dice.[94]

Taxation of wealth [edit]

Senator Bernie Sanders pitched the idea of a wealth tax in the US in 2014.[95] Afterwards, Senator Elizabeth Warren proposed an annual tax on wealth in January 2019, specifically a 2% taxation for wealth over $50 meg and another 1% surcharge on wealth over $ane billion. Wealth is divers every bit including all asset classes, including financial assets and real manor. Economists Emmanuel Saez and Gabriel Zucman estimated that about 75,000 households (less than 0.i%) would pay the tax. The taxation would raise effectually $two.75 trillion over x years, roughly one% Gdp on average per yr. This would raise the full revenue enhancement burden for those subject area to the wealth taxation from 3.two% relative to their wealth under electric current constabulary to most iv.iii% on average, versus the 7.two% for the bottom 99% families.[96] For scale, the federal budget deficit in 2018 was 3.9% Gdp and is expected to rise towards 5% GDP over the next decade.[97]

The program received both praise and criticism. Two billionaires, Michael Bloomberg and Howard Schultz, criticized the proposal as "unconstitutional" and "ridiculous," respectively. Economist Paul Krugman wrote in January 2019 that polls indicate the idea of taxing the rich more is very popular.[98] In 2021, officials in the land of Washington considered proposals to revenue enhancement wealthy residents within the state.[99]

Limit or tax stock buybacks [edit]

Senators Charles Schumer and Bernie Sanders advocated limiting stock buybacks to reduce income and wealth inequality in January 2019.[100]

See also [edit]

- Affluence in the United states

- Distribution of wealth in Europe

- Citizens United five. Federal Ballot Committee

- Donor Class

- Income inequality in the United States

- Monetary policy

- Net worth

- Occupy movement

- Occupy Wall Street

- Oligarchy

- Panama Papers

- Paradise Papers

- Pareto principle

- Plutocracy

- Power aristocracy

- Redistribution of wealth

- Tax Policy and Economical Inequality in the United States

- The Divide: American Injustice in the Historic period of the Wealth Gap

- Wealth concentration

- Wealth in the United States

- We are the 99%

- American upper course

- List of Americans by net worth

References [edit]

- ^ "Trends in Family Wealth, 1989 to 2013". Congressional Budget Office. Baronial xviii, 2016. Retrieved November 29, 2016.

- ^ Rugaber, Christopher S.; Boak, Josh (January 27, 2014). "Wealth gap: A guide to what information technology is, why it matters". AP News . Retrieved January 27, 2014.

- ^ Hurst, Charles East. (2007), Social Inequality: Forms, Causes, and Consequences, Pearson Education, Inc., p. 31, ISBN978-0-205-69829-v

- ^ a b "Distributional National Accounts". federalreserve.gov. Feb 16, 2020. Retrieved Feb xx, 2020.

- ^ Hurst, Charles E. (2007), Social Inequality: Forms, Causes, and Consequences, Pearson Education, Inc., p. 31, ISBN978-0-205-69829-five

- ^ Anthony Shorrocks; Jim Davies; Rodrigo Lluberas (October 2018). "Global Wealth Study". Credit Suisse. Oct 10, 2018 article: Global Wealth Report 2018: US and China in the lead. Report [ permanent dead link ] . Databook [ permanent dead link ] . Downloadable information sheets. Encounter Table 3.1 (page 114) of databook for mean and median wealth by country. See folio 106 (end of Tabular array two.4) for total wealth of continents.

- ^ Norton, M.I.; Ariely, D. (2011). "Building a Meliorate America – Ane Wealth Quintile at a Fourth dimension" (PDF). Perspectives on Psychological Science. half dozen (i): ix–12. doi:ten.1177/1745691610393524. PMID 26162108. S2CID 2013655. (video)

- ^ a b "New Federal Reserve data shows how the rich have gotten richer". vox.com. June xiii, 2019. Retrieved October vi, 2020.

- ^ Ratcliff, Anna (January 16, 2017). "Simply 8 men own same wealth equally half the world". Oxfam . Retrieved January 16, 2017.

- ^ Mullany, Gerry (January 16, 2017). "Globe'south 8 Richest Take every bit Much Wealth as Lesser Half of Global Population". The New York Times . Retrieved January sixteen, 2017.

- ^ Elliott, Larry (Jan 15, 2017). "World's viii richest people take aforementioned wealth equally poorest fifty%". The Guardian . Retrieved January xvi, 2017.

- ^ Grusky, David B. Social Stratification: Class, Race, and Gender in Sociological Perspective, p. 637. Westview Press, 2001 ISBN 0-8133-6654-2

- ^ Keister, p. 64

- ^ America'southward wealth gap 'unsustainable,' may worsen: Harvard study. Reuters, September 8, 2014.

- ^ a b c Recent Trends in Household Wealth in the United States: Rising Debt and the Eye-Class Clasp—an Update to 2007 past Edward North. Wolff, Levy Economics Institute of Bard College, March 2010

- ^ "Trends in U.S. Income and wealth inequality". January 9, 2020.

- ^ a b Hurst, p. 34

- ^ a b Occupy Wall Street And The Rhetoric of Equality Forbes Nov i, 2011 by Deborah L. Jacobs

- ^ Wealth, Income, and Ability by G. William Domhoff of the UC-Santa Barbara Sociology Department

- ^ Kertscher, Tom; Borowski, Greg (March 10, 2011). "The Truth-O-Meter Says: Truthful – Michael Moore says 400 Americans take more than wealth than one-half of all Americans combined". PolitiFact . Retrieved Baronial 11, 2013.

- ^ Pepitone, Julianne (September 22, 2010). "Forbes 400: The super-rich become richer". CNN . Retrieved August 11, 2013.

- ^ Bruenig, Matt (March 24, 2014). "You phone call this a meritocracy? How rich inheritance is poisoning the American economic system". Salon . Retrieved Baronial 24, 2014.

- ^ "Inequality – Inherited wealth". The Economist. March xviii, 2014. Retrieved August 24, 2014.

- ^ Pizzigati, Sam (September 24, 2012). "The 'Self-Fabricated' Hallucination of America'south Rich". Institute for Policy Studies . Retrieved August 24, 2014.

- ^ "Household wealth inequality statistics from the Federal Reserve". Federal Reserve. March 18, 2020.

- ^ Weissmann, Jordan (March 11, 2013). "Yes, U.South. Wealth Inequality Is Terrible by Global Standards". The Atlantic . Retrieved March xvi, 2013.

- ^ Peter Baldwin (2009). The narcissism of small differences: how America and Europe are alike. Oxford Academy Press. ISBN 978-0-19-539120-half-dozen

- ^ Marking Gongloff (October 14, 2014). Key Inequality Measure The Highest Since The Neat Depression. The Huffington Post. Retrieved October fourteen, 2014.

- ^ Pensions, Social Security, and the Distribution of Wealth by Arthur B. Kennickell and Annika E. Sundén of Board of Governors of the Federal Reserve System

- ^ Svaldi, Aldo (January eleven, 2014). "Robert Reich: Income inequality the defining issue for U.South." The Denver Mail service . Retrieved January 26, 2014.

- ^ Bruenig, Matt (October 1, 2017). "Wealth Inequality Is College Than E'er". Jacobin . Retrieved July 27, 2018.

- ^ Steverman, Ben (June sixteen, 2017). "The U.S. Is Where the Rich Are the Richest". Bloomberg . Retrieved October 22, 2017.

Now, those policies and their progeny have helped put 63 percent of America'due south private wealth in the hands of U.South. millionaires and billionaires, BCG said. Past 2021, their share of the nation'due south wealth will rise to an estimated 70 pct.

- ^ Rogers, Taylor Nicole (October ix, 2019). "American billionaires paid less in taxes in 2018 than the working class, analysis shows — and it's another sign that one of the biggest problems in the Usa is only getting worse". Business organisation Insider . Retrieved February two, 2020.

- ^ Ingraham, Christopher (October 8, 2019). "For the starting time time in history, U.S. billionaires paid a lower revenue enhancement charge per unit than the working class last year". The Washington Mail service . Retrieved February 2, 2020.

- ^ "Are federal taxes progressive?". Tax Policy Center . Retrieved February ii, 2020.

- ^ Wamhoff, Steve., Gardner, Matthew (April 2019). "Who Pays Taxes in America in 2019?" (PDF). Institute on Taxation and Economic Policy.

- ^ "The Federal Reserve's new distributional financial accounts provide telling information on growing U.South. wealth and income inequality". equitablegrowth.org. Baronial 22, 2019. Retrieved February 17, 2020.

- ^ Bruenig, Matt (September 28, 2020). "Millionaires and Billionaires Own 79% of All Household Wealth". People'south Policy Projection . Retrieved October v, 2020.

- ^ Krystal and Saagar: NEW Information Shows Millionaires, Billionaires Own 79% Of America'south Wealth Ascent on YouTube, September 29, 2020.

- ^ Kertscher, Tom (July 3, 2019). "The wealthiest three families at present own more wealth than the bottom half of the country. - TRUE". PolitiFact . Retrieved June 13, 2021.

- ^ Kertscher, Tom (March ten, 2011). "Just 400 Americans -- 400 -- accept more wealth than half of all Americans combined. - True". PolitiFact . Retrieved June 13, 2021.

- ^ Bogdan, Dennis (April 26, 2013). "Comment - USA: More Valuable Than Coin?". The New York Times . Retrieved June xiii, 2021.

- ^ Picchi, Aimee (Dec 7, 2021). "The new Gilded Age: 2,750 people have more wealth than half the planet". CBS News . Retrieved Dec 9, 2021.

- ^ "World Inequality Report 2022". Retrieved December nine, 2021.

- ^ "He noted a sharp reduction in income inequality in the United States betwixt 1913 and 1948. More specifically, at the showtime of this period, the upper decile of the income distribution (that is, the top 10 percent of US earners) claimed 45–50 per centum of almanac national income. By the late 1940s, the share of the peak decile had decreased to roughly 30–35 per centum of national income." Piketty, Thomas. Capital in the Twenty-Offset Century (Kindle Locations 298–300). Harvard University Press. Kindle Edition.

- ^ a b "Total Net Worth". fred.stlouisfed.org. Oct x, 2020. Retrieved Oct x, 2020.

- ^ a b c d e While Trump Touts Stock Market, Many Americans Are Left Out of the Conversation. By Danielle Kurtzleben, March 1, 2017. NPR.

- ^ Grusky, folio 637

- ^ Gilbert, D. (1998). The American Class Structure: In an Historic period of the Growing Inequality. Belmont, CA: Wadsworth.

- ^ "U.S. Demography Bureau, Housing and Household Economic Statistics Partitioning; Income Overview". Dec 20, 2005. Retrieved February 10, 2019.

- ^ a b Keister, p. 65

- ^ "Federal Reserve Bank of Chicago, Savings of Young Parents" (PDF). December 2000. Retrieved Feb x, 2019.

- ^ Information technology's the Inequality, Stupid Past Dave Gilson and Carolyn Perot in Mother Jones, March/April 2011 Event

- ^ Who are the 1 percent?, CNNMoney.com, October 29, 2011

- ^ "Tax Data Show Richest 1 Percent Took a Striking in 2008, But Income Remained Highly Concentrated at the Height." Centre on Budget and Policy Priorities. Accessed Oct 2011.

- ^ Peak Earners Doubled Share of Nation's Income, Study Finds The New York Times By Robert Pear, October 25, 2011

- ^ An ordinary Joe, The Economist, June 23, 2012

- ^ The Cost of Inequality: How Today's Divided Order Endangers Our Future, Stiglitz, J.East.,(2012) W.W. Norton & Company, ISBN 978-0393088694

- ^ Lowrey, Annie (September 10, 2013). "The Rich Go Richer Through the Recovery".

- ^ a b The Acme 1 Percent - What Jobs Practise They Take?. The New York Times January 14, 2012

- ^ Divided We Stand: Why Inequality Keeps Rise. OECD (2011)

- ^ The Richest 10% of Americans Now Ain 84% of All Stocks. Past Rob Wile, December 19, 2017. Money.com.

- ^ Federal Reserve Bulletin. September 2017, Vol. 103, No. 3. See PDF: Changes in U.S. Family Finances from 2013 to 2016: Prove from the Survey of Consumer Finances. Table 1 (on the left) is taken from page 4 of the PDF. Table two (on the correct) is taken from page 13. See: Survey of Consumer Finances and more than data.

- ^ a b Rattner, Steven (January 22, 2018). "Opinion - The Market Isn't Bullish for Everyone". The New York Times . Retrieved March 23, 2018.

- ^ "Productivity growth closely matched that of median family income until the late 1970s when median American family income stagnated while productivity continued to climb. Chart comparing productivity growth and real median family income growth in the United States from 1947–2009. Source: EPI Authors' assay of Current Population Survey Annual Social and Economical Supplement Historical Income Tables, (Tabular array F–5) and Bureau of Labor Statistics Productivity – Major Sector Productivity and Costs Database (2012)". Retrieved February 10, 2019.

- ^ "Global wage growth stagnates, lags backside pre-crunch rates, ILO, Dec five, 2014". December 5, 2014. Retrieved February x, 2019.

- ^ "Federal Reserve-Survey of Consumer Finances 2017". Retrieved February 10, 2019.

- ^ a b c Hurst, p. 36

- ^ Grusky, p. 640

- ^ Leung, May (January 22, 2015). "The Causes of Economic Inequality". 7 Pillars Institute . Retrieved Jan 14, 2019.

- ^ "Emmanuel Saez-Striking it richer: The evolution of top incomes in the U.S." (PDF). June thirty, 2016. Retrieved February 10, 2019.

- ^ Hurst, pp. 34–35

- ^ Kristof, Nicholas (July 22, 2014). "An Idiot's Guide to Inequality". The New York Times . Retrieved July 22, 2014.

- ^ Berman, Y; Shapira, Y; Ben-Jacob, E (2015). "Modeling the Origin and Possible Control of the Wealth Inequality Surge. PLoS 1 10(six): e0130181,1". doi:10.1371/journal.pone.013018 (inactive February 28, 2022). Retrieved Feb ten, 2019. CS1 maint: DOI inactive as of February 2022 (link)

- ^ Zyga Fifty, Model shows how surge in wealth inequality may be reversed, http://phys.org/news/2015-07-surge-wealth-inequality-reversed.html, 2015

- ^ Berman Y, Ben-Jacob E, Shapira Y (2016) The Dynamics of Wealth Inequality and the Effect of Income Distribution. PLoS 1 eleven(four): e0154196, http://journals.plos.org/plosone/article?id=ten.1371/journal.pone.0154196

- ^ Berman, Y; Peters, O; Adamou, A (2016). "Far from equilibrium: Wealth reallocation in the United states". arXiv:1605.05631 [q-fin.EC].

- ^ Stiglitz, Joseph Eastward. (June 4, 2012). The Price of Inequality: How Today'south Divided Social club Endangers Our Future (Kindle Locations 1148–1149). Norton. Kindle Edition.

- ^ a b Thomas Shapiro; Tatjana Meschede; Sam Osoro (February 2013). "The Roots of the Widening Racial Wealth Gap: Explaining the Black-White Economical Split" (PDF). Research and Policy Brief. Brandeis University Institute on Assets and Social Policy. Retrieved March sixteen, 2013.

- ^ Avery, Robert B.; Rendall, Michael S. (2002), Lifetime Inheritances of Three Generations of Whites and Blacks, vol. 107, The Academy of Chicago Press

- ^ Keister, Lisa A. (2004). "Race, Family Structure, and Wealth: The Effect of Childhood Family unit on Adult Asset Ownership" (PDF). Sociological Perspectives. 47 (ii): 161–87. doi:10.1525/sop.2004.47.2.161. S2CID 11945433.

- ^ Moore, Antonio; Attorney, ContributorLos Angeles; Documentary, Emmy Nominated Producer 'Superhighway Scissure in The System' (April 13, 2015). "America'due south Financial Divide: The Racial Breakup of U.Due south. Wealth in Black and White". HuffPost.

- ^ a b c "Our Real Racial Wealth Gap Story". Inequality.org.

- ^ "Stance: Black Wealth Inappreciably Exists, Even When You Include NBA, NFL and Rap Stars". EURweb. October 12, 2016.

- ^ Singh, Lillian D. (September 26, 2014). "Black Wealth On TV: Realities Don't Match Perceptions". The American Prospect.

- ^ a b c "Wealth inequality has widened along racial, indigenous lines since end of Great Recession" (PDF).

- ^ Martin Gilens & Benjamin I. Page (2014). "Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens" (PDF). Perspectives on Politics. 12 (3): 564–581. doi:10.1017/S1537592714001595. S2CID 8472579.

- ^ "'Corruption is Legal in America' by RepresentUs". YouTube. Archived from the original on December 12, 2021.

- ^ John Nichols (May 7, 2014). Bernie Sanders Asks Fed Chair Whether the United states Is an Oligarchy. The Nation. Retrieved May 8, 2014.

- ^ Piketty, Thomas (2014). Capital in the 20-Get-go Century. Belknap Press. ISBN 067443000X pp. 26, 514

- ^ Conley, Julia (March 20, 2019). "Social Autonomous Nations Rank Happiest on Global Alphabetize (Again). US Ranking Falls (Again)". Common Dreams . Retrieved March 31, 2019.

- ^ "FRED Chart - Wealth inequality by wealth grouping 1989-Nowadays". fred.stlouisfed.org. March ix, 2020.

- ^ Heather Long, Nov. 5 2017, The Washington Post "3,200 wealthy individuals wouldn't pay estate tax side by side year under GOP programme" Retrieved xxx August 2018.

- ^ Jeff Ernsthausen; James Bandler; Justin Elliott; Patricia Callahan (September 26, 2021). "More Than Half of America's 100 Richest People Exploit Special Trusts to Avert Estate Taxes". ProPublica.

- ^ "Sanders Proposes Wealth Tax; Piketty, Reich Applaud-September 6, 2014".

- ^ "Saez & Zucman-Scoring of the Warren Wealth Revenue enhancement Proposal-Jan 18, 2019" (PDF).

- ^ "The Budget and Economic Outlook: 2019 to 2029 - Congressional Budget Office". www.cbo.gov. January 28, 2019.

- ^ Krugman, Paul (January 28, 2019). "Opinion - Elizabeth Warren Does Teddy Roosevelt". The New York Times.

- ^ Mahoney, Laura (March 4, 2021). "Mega-Rich and Plans to Tax Them Abound in Washington Country". Bloomberg Tax.

- ^ Schumer, Chuck; Sanders, Bernie (Feb 3, 2019). "Opinion - Schumer and Sanders: Limit Corporate Stock Buybacks". The New York Times.

Further reading [edit]

- Alexandra Thornton and Galen Hendricks, Ending Special Revenue enhancement Treatment for the Very Wealthy, Center for American Progress, June 4, 2019. Ending Special Taxation Treatment for the Very Wealthy The report summarizes the trouble (gross inequality) and its cause ("special tax handling for the [extremely rich]"), and specific "ways to rebalance the tax lawmaking and put the economic system on a better track."

- Moritz Kuhn, Moritz Schularick, and Ulrike I. Steins. 2020. "Income and Wealth Inequality in America, 1949–2016." Journal of Political Economy.

- Thomas Grand. Shapiro (2017). Toxic Inequality: How America'south Wealth Gap Destroys Mobility, Deepens the Racial Divide, and Threatens Our Futurity. Basic Books. ISBN978-0465046935.

Source: https://en.wikipedia.org/wiki/Wealth_inequality_in_the_United_States