How to Check if a String Is a Number

How To Read a Check: Easily Find Your Account and Routing Numbers

- When To Use a Check

- Parts of a Check

- Why Use Checks

- Takeaways

With the advent of Paypal, Venmo and Bitcoin, checks seem so last century, but that doesn't mean you no longer need to know how to read a check for banking information.

You might be surprised that in 2018 — the most recent year for which statistics are available — there were still 14.5 billion check payments written, according to the Federal Reserve Board. At the bottom of your check, you'll see three groups of numbers. Your routing number is in the first group, your account number is in the second, and your check number is in the third group.

When To Use a Check

Some online transactions require an understanding of how to read a check and where to look for important information. For example, you might need information from your checks to set up direct deposit or arrange an electronic transfer straight into your account. To do either of these, you need to know how to decipher your check account and routing numbers.

Reading a check is simple, but to understand how to read a check and differentiating between routing and account numbers, or how to read a government check and set up direct deposits, use the following illustrated guide to learn.

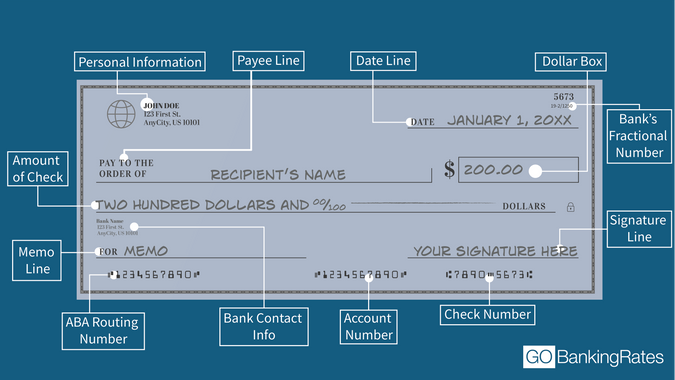

What Are the Parts of a Check?

Here are the different parts of a check.

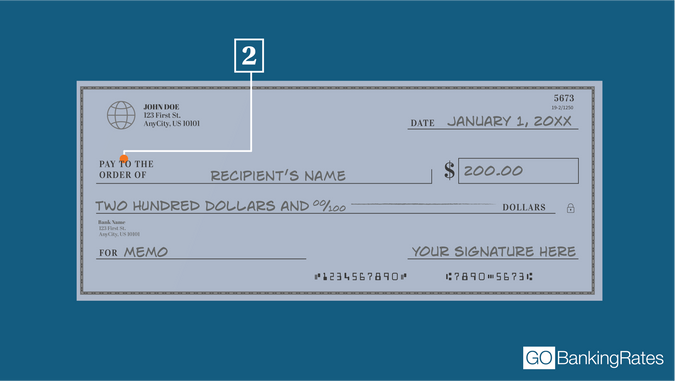

1. Personal Information

In the upper left-hand corner of the check, you'll find the personal information of the person to whom the account belongs. This typically includes their name and address.

2. Payee Line

On the payee line, you'll find text that reads "Pay to the order of." This is the person or business to whom the money will be paid. If the check is made out to you, then you're the payee. You'll need to endorse the check by signing the back when you're ready to cash it. Don't endorse it until you are ready to cash or deposit it.

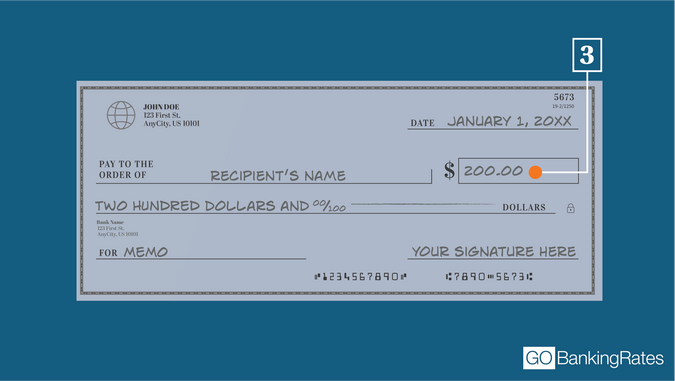

3. The Dollar Box

Inside the dollar box, you'll find the amount that the check is worth written in numbers. Write your amount like this: $20.65.

Begin writing as close to the left side of the box as possible with the dollar sign snug against the first number. You don't want someone to alter the check to $2220.65.

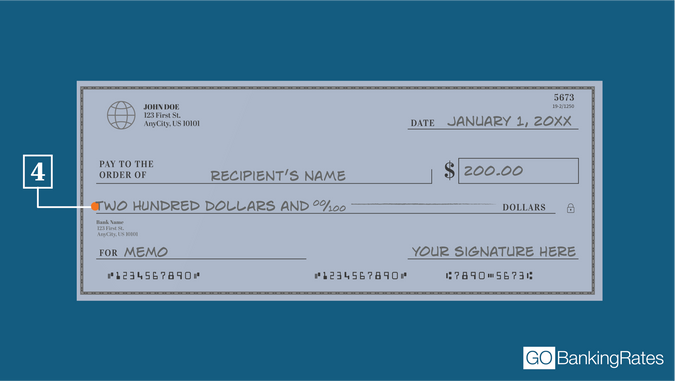

4. The Amount of the Check

Write the dollar amount out in words on this line, which is below the payee line. The cents, however, will still be in number format. For example, the amount line would say "Twenty dollars and 65/100" for a check that amounts to $20.65. It must match the amount in the dollar box.

If there is any room left over on this line once you've written out the total amount, you can strike through the remaining space so that no one can adjust the amount without your knowledge.

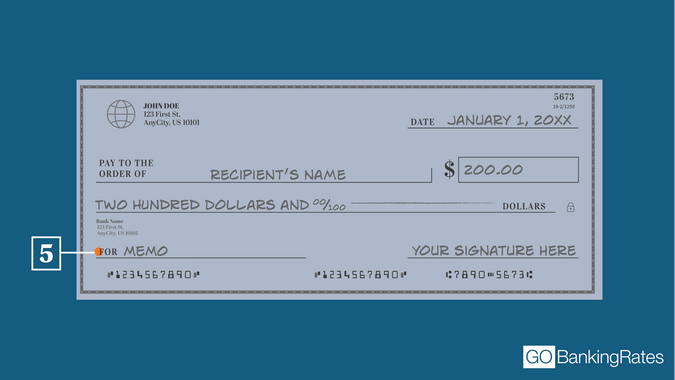

5. Memo Line

The memo line is optional, but it's good practice for keeping track of check payments. The memo line is used to signal the reason for the transaction. For example, a renter could write "March 2021 rent" on the memo line when writing a check to the landlord.

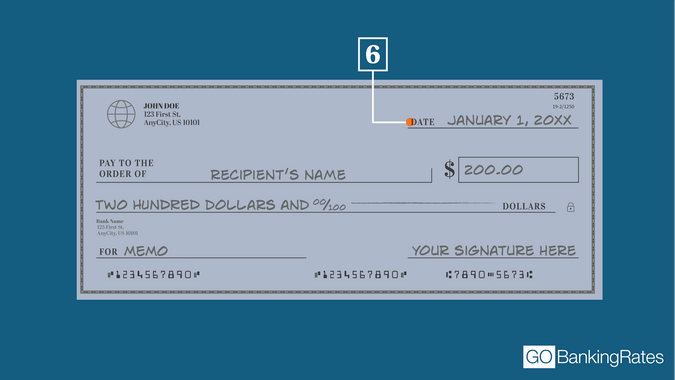

6. Date Line

On the date line, you'll find the date the check was written.

Sometimes, the paying party might postdate the check to indicate when the payee should cash it. For example, you might make out a check on March 5, but write March 15 in the date line. This often is done if account funds won't be available until a specified future time.

Although the payee potentially could take this as a direction to wait before cashing a check, the check is valid from the moment it's signed by the issuer. The payee doesn't have to wait until the date on the date line to cash the check. If the payee attempts to cash the check before the date on this line and the check bounces, the person who wrote the check and the one who cashes it could face fees from their bank.

Check Out Our Free Newsletters!

Every day, get fresh ideas on how to save and make money and achieve your financial goals.

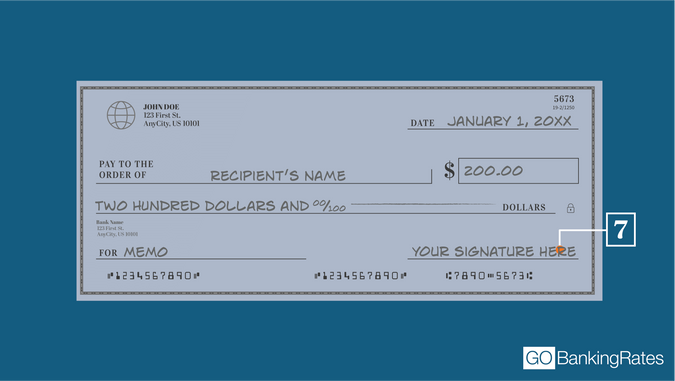

7. Signature Line

The issuer will sign this line to authorize the check.

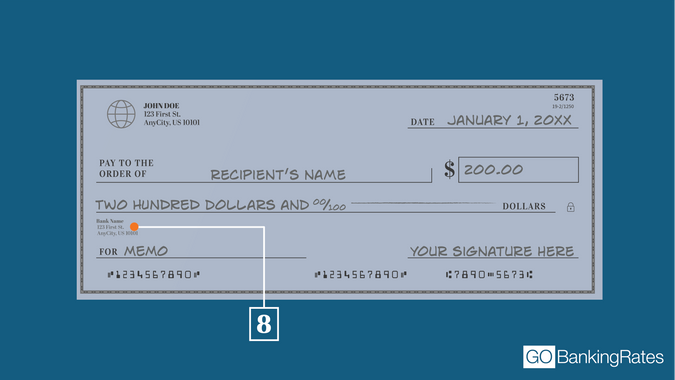

8. Bank Name

If you have any questions or concerns about a check, you can contact the bank that is listed on the check.

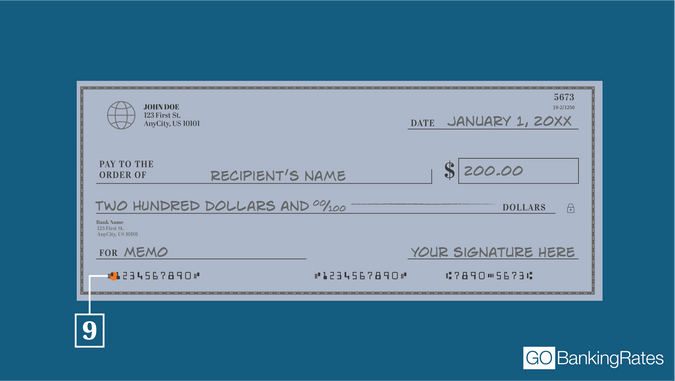

9. Bank's ABA Routing Number

The ABA routing number is a nine-digit number assigned to your bank by the American Bankers Association. This indicates the bank through which the funds will be withdrawn.

You'll also use your ABA routing number to set up direct deposit and recurring payments. Some banks will have more than one routing number depending on their size, so always make sure you're using the correct routing number before setting up these types of payments.

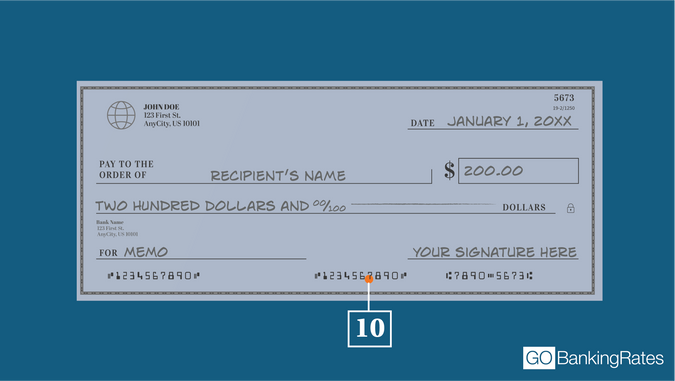

10. The Account Number

This is the number that's associated with the checking account from which the funds will be withdrawn. It is the second set of numbers printed at the bottom of your checks. The routing number is first, at the far left.

11. Check Number

The check number is used to identify the individual check. That set of numbers is located at the far right along the bottom of your checks.

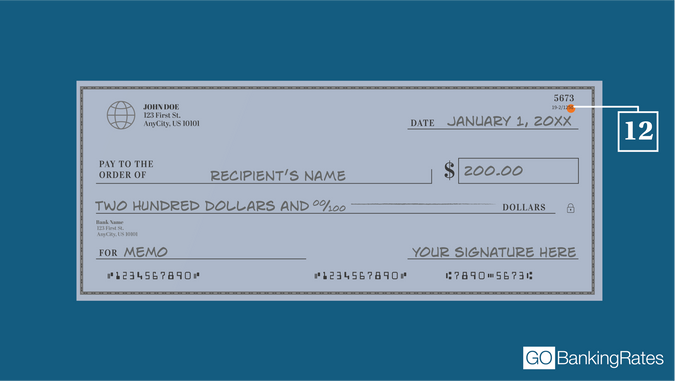

12. Bank's Fractional Number

The fractional number, usually placed toward the top right of your check, contains numbers that correspond with your bank, such as your routing number. Because these numbers are readily available elsewhere on the check, the fractional number isn't widely used anymore.

You might notice that the routing and account numbers at the bottom of the check look like symbols. It's a special font known as magnetic ink character recognition, or MICR. This special ink can be read by check-sorting machines.

Reading a Check Is a Useful Skill To Have

If you learn how to read check details on a personal account, you'll also know how to read a cashier's check and how to read a business account check.

Why Checks Are Still Useful

- Not everyone knows how to use cash apps, and some people don't have a mobile phone or computer.

- Some people just like the simplicity and time-tested reliability of writing a check.

- When compared with cash, checks are much more secure. If your wallet is stolen, your cash is probably as good as gone. If you're sending money as a birthday gift, you'll risk losing that cash in the mail.

One drawback of checks is that anyone who gets their hands on one of your checks now knows your name, address, bank information and account number.

Key Takeaways

Need to know your routing number and don't have a check handy? You can also find your routing number by:

- Using the ABA routing number lookup tool

- Checking your bank's website

You also can find your bank account number on your banking statement. If all else fails, you can call or visit the bank to find out the routing and account numbers.

No matter how you prefer to do your banking, being able to read a check is a good skill to have in case you might run into a situation where checks are the best or only valid form of payment.

This article has been updated with additional reporting since its original publication.

Erika Giovanetti is a Charlotte, NC-based writer and editor who enjoys spending time in nature, reading modern fiction and non-fiction, unearthing and recreating family recipes, playing with her kittens and spending time with friends and family.

How to Check if a String Is a Number

Source: https://www.gobankingrates.com/banking/checking-account/how-to-read-a-check/